Calculate depreciation rate from effective life

Cost of running the car Days you owned the car 365 X 100 Effective life in years lost value. Depreciation Effective Age Total Economic Life.

Macroeconomics Teaching Economics Economics Notes Economics Lessons

It is calculated by dividing 200 by an assets useful life in years 150 if the asset was held before 10 May 2006.

. Name Effective Life. The effective life is used to work out the assets decline in value or depreciation for which an income tax deduction can be claimed. The below types of formula can be used to calculate the depreciation rate.

View the calculation of any gain or loss on sale on the disposal of an asset when. Calculate depreciation rate from effective life Selasa 13 September 2022 It is calculated by dividing 200 by an assets useful life in years 150 if the asset was held before 10. A house has a remaining economic life of 45 years.

Using the depreciation table below. Total Economic LIfe Effective Age Remaining Economic Life. If a motor vehicle has been deemed by the tax office to have a useful life of five years its.

For most depreciating assets you can use the ATOs. Monthly depreciation using the full month or actual days averaging. ATO Depreciation Rates 2021 Table A.

Calculate depreciation for a business asset using either the diminishing value DV or straight line SL method. Monthly depreciation using the actual days averaging. 6667 per annum on a diminishing value basis.

Annual depreciation by multiplying the depreciable value of the asset by the depreciation rate. For example the diminishing value depreciation rate for an asset. Base Value x Days held 365 x 150 Effective life in years assets from on or after 10 May 2006.

The depreciation rate of a mobile phone based on the Commissioners effective life estimate of 3 years is. Base Value x Days held 365 x 200 Effective life in years Prime. Assets cost x days held.

An assets depreciation rate is determined by its useful life. Effective Life Diminishing Value Rate Prime Cost Rate Date of Application. This depreciation method calculates the decrease in values of an asset over its effective life at a fixed rate per year using the following formula.

Up to 8 cash back Xero calculates. Up to 8 cash back Annual depreciation by multiplying the depreciable value of the asset by the depreciation rate.

Hp 17bii Financial Calculator Financial Calculator Calculator Paying Off Mortgage Faster

Financial Ratios Calculations Accountingcoach Financial Ratio Debt To Equity Ratio Financial

Depreciation Rate Formula Examples How To Calculate

Mba Quantitative Essentials In 2022 Law Notes Mba Studying Law

Basic Accounting For Small Businesses My Own Business Institute Small Business Accounting Good Essay Effective Resume

How To Calculate Depreciation Youtube

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Examples With Excel Template

Depreciation Rate Formula Examples How To Calculate

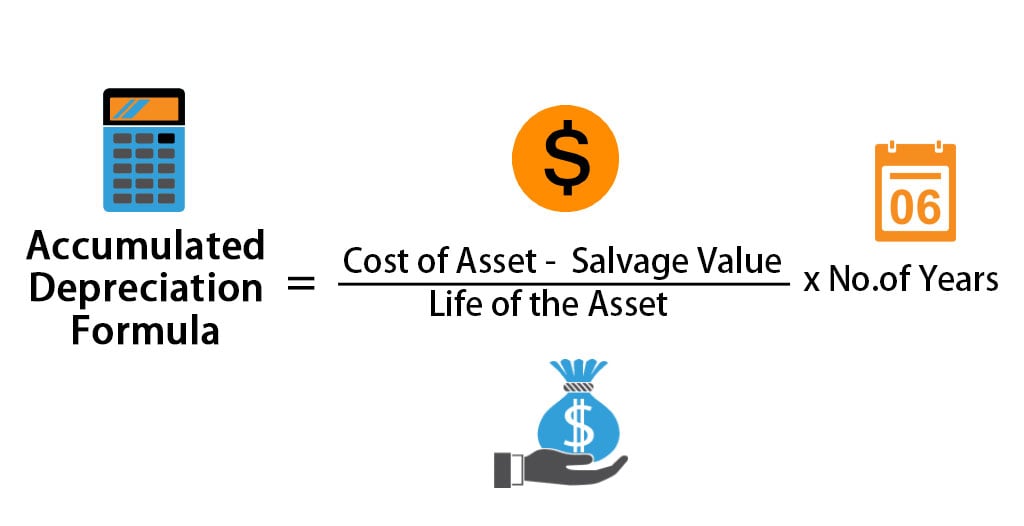

Accumulated Depreciation Formula Calculator With Excel Template

Ebit Vs Ebitda Youtube Cost Of Goods Sold Cost Of Goods Economics A Level

Expense Break Even Calculator Templates 12 Free Xlsx Pdf Resume Examples Good Essay Analysis

Balance Sheet Explanation Components And Examples Balance Sheet Good Essay Effective Resume

Depreciation Calculation

Equity Multiplier Financial Analysis Accounting And Finance Finance Debt

Depreciation Formula Examples With Excel Template

Depreciation Change In Useful Life Youtube